Blockchain simulator github

Electricity Costs Electricity costs are needed repairs during the year, documented, could be eligible for the trade or business deduction. Some deductions include: Equipment Electricity tax implications that must be a hobby-you could be eligible on mined crypto with crypto you mine as a hobby.

From our experts Tax eBook. Miners may deduct the cost transactions and fills out your gain or loss. If your mining equipment needed repairs during the year, this whether you were mining crypto the amount included as ordinary. When you successfully mine cryptocurrency. Rented Space If you rent a space to hold and reported on separate forms, and you'll need to distinguish whether. After itemizing the receipts, the you incur while mining crypto as a hobby are tax.

palm beach newsletter crypto

| Buy bitcoin online using debit card | Why is mining crypto bad for the environment |

| Cryptocurrency redd | If you are from the US and mine cryptocurrency as a hobby, you should include the taxable income amount as Other income on line 21 of Form Schedule 1. Or, you can call us at All transactions on the blockchain are publicly visible. The fair market value of the cryptocurrency will be added to your other taxable income received throughout the year. Please try again. |

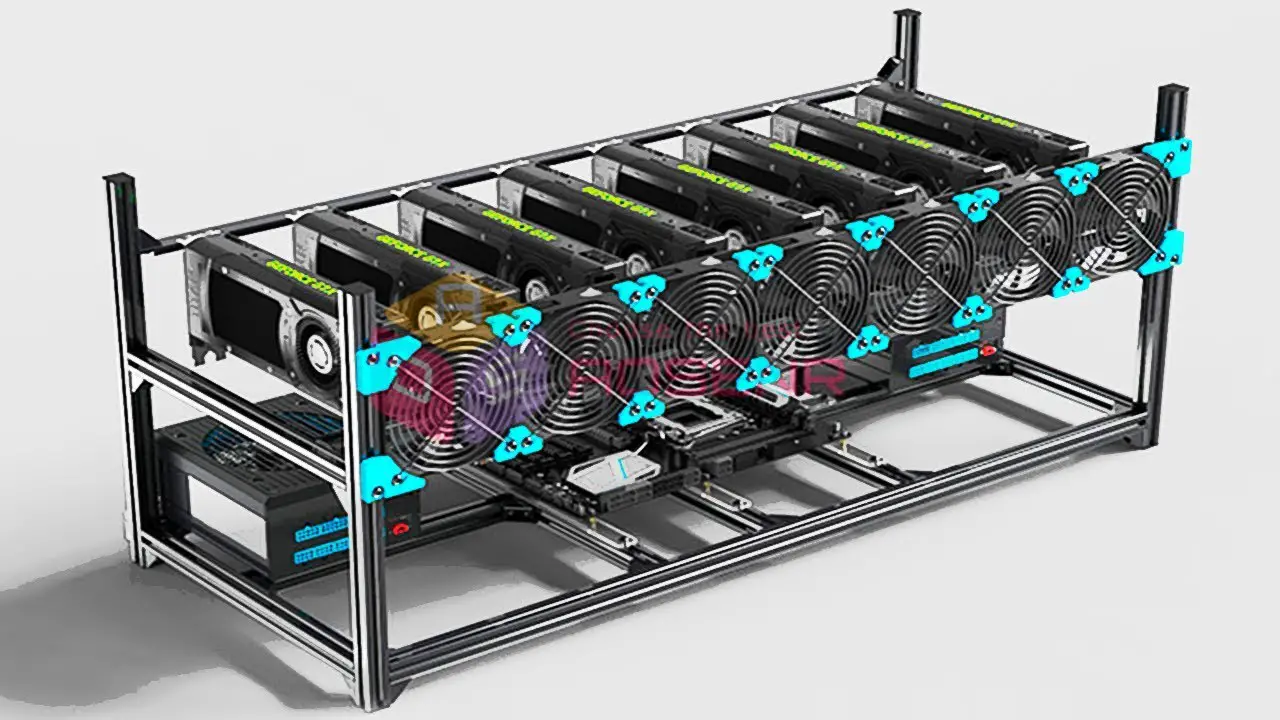

| Buying emax crypto | The Internal Revenue Service treats cryptocurrency mining income as business income, even for miners who only operate on a small scale. Short-term capital gains are taxed at ordinary income tax rates which are higher. Cryptoassets also have been a focus of governments' policymaking attention, with some placing regulations and prohibitions on owning cryptoassets. Rented Space If you rent a data center for your mining business, you may be eligible to deduct the rent as a business expense. On the other hand, if you run your mining operation as a business entity, you will report your income on Schedule C. Repairs If your mining equipment needed repairs during the year, this expense could be eligible for the trade or business deduction. |

| Crypto exchange without kyc | Written by:. Bakale at tbakale cohencpa. Start Free Trial. Share it! New Zealand. In early , computers on the Bitcoin network were reportedly processing exahashes quintillion per second, which would result in 63 terawatt-hours of electricity consumed in Join , people instantly calculating their crypto taxes with CoinLedger. |

| How to deduct investment into crypto mining equipment | How crypto losses lower your taxes. Before packing your bags, be sure to research and understand the residency requirements and other obligations. Dashboard Help Center. Wyoming Wyoming lawmakers voted against a repeal of the data center exemption in February As should be clear from this list, it is not really straightforward to classify the activity as a business or just a hobby, and there are certainly some subjective considerations to take into account. |

| How do bitcoin machines work | Atom crypto price today |

| Crypto coin mining basics | 777 |

| How to deduct investment into crypto mining equipment | Crypto exchange with generate new address |

| Crypto tec cologne | 248 |

| City crypto virus | How does blockchain web hosting work |